23

Points

Questions

4

Answers

7

-

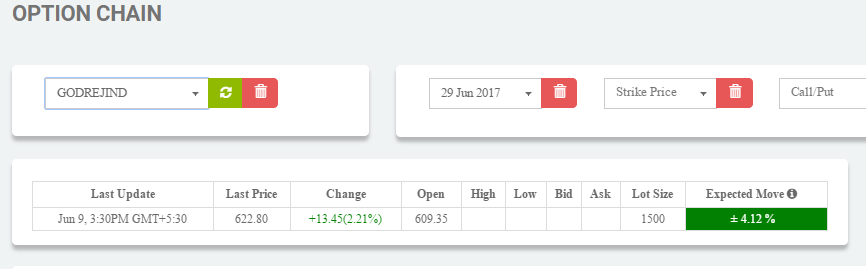

Asked on June 9, 2017 in Options Strategies.

You cannot use Expected Move to predict market direction. But Expected move can be used only to predict the Expected Range on any event like earnings results or any planned corporate announcement aka binary events. It is just a high probability range apart from that Expected range cant be used for speculative strategies but to build option strategies to benefit out of that insane range mostly directionless market neutral strategies .

- 4836 views

- 3 answers

- 0 votes

-

Asked on June 9, 2017 in Options Strategies.

Expected move is the amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events. We use this calculation on the day before the binary event or very close to the expiration date. The expected move of an stock for a binary event can be found by calculating 85% of the value of the front month at the money (ATM) straddle. Add the price of the front month ATM call and the price of the front month ATM put, then multiply this value by 85%. Another easy way to calculate the expected move for a binary event is to take the ATM straddle, plus the 1st OTM strangle and then divide the sum by 2.

You can learn more about expected move here

https://www.tastytrade.com/tt/learn/expected-move

http://www.marketcalls.in/option-action/calculate-expected-move-stockindex.html

- 4836 views

- 3 answers

- 0 votes

-

Asked on June 9, 2017 in Options Strategies.

- 3275 views

- 1 answers

- 0 votes

-

Asked on June 9, 2017 in Options Strategies.

Hi Kalpesh,

Only a directional strategies can bring 3x times returns expectations. You cannot play with neutral or directionless strategies. When you want to go with directional approach and want to maximize your returns only way to approach is buying naked call or naked puts but then it comes with lower accuracy.

Far the OTM strike lesser the accuracy. However you can improve your accuracy by selecting near OTM strikes rather than deep OTM strikes.

- 3368 views

- 1 answers

- 0 votes

-

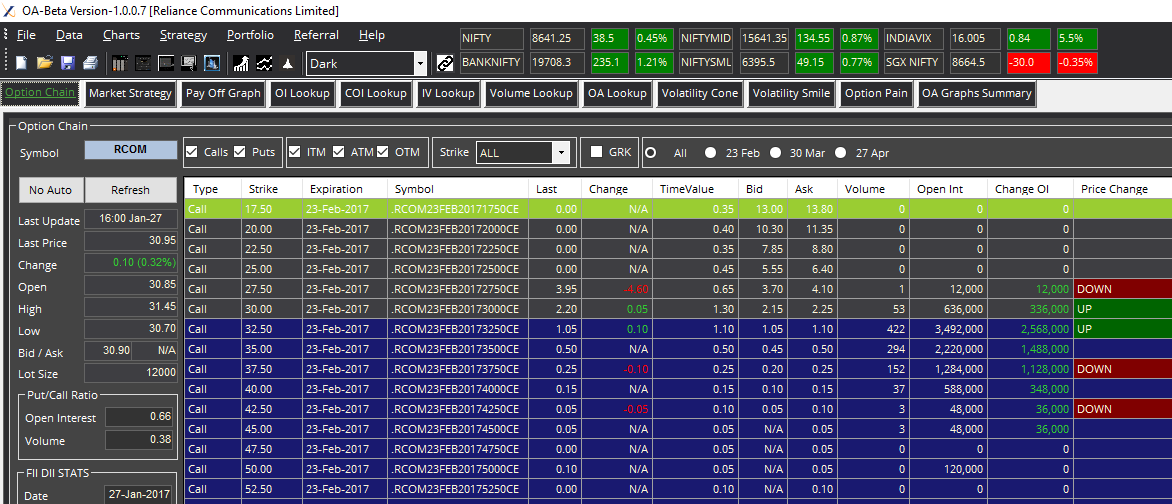

Asked on January 28, 2017 in OptionAction.

- 3540 views

- 2 answers

- 0 votes

-

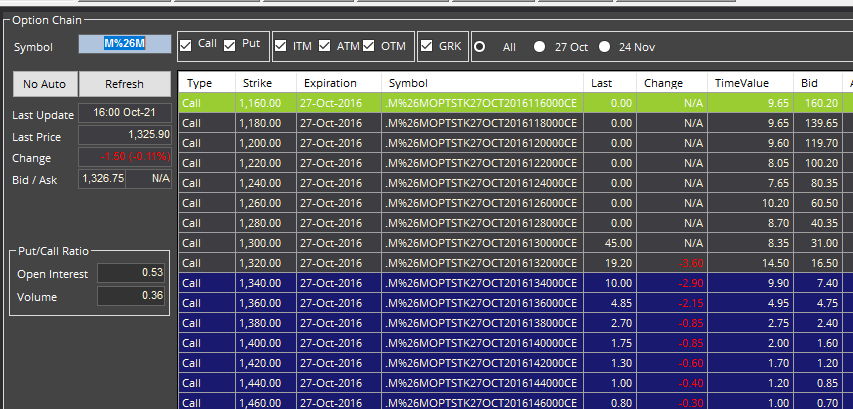

Asked on October 23, 2016 in OptionAction.

- 3500 views

- 2 answers

- 0 votes

-

Asked on October 22, 2016 in Options Strategies.

How about a covered call strategy. Can one build monthly income using covered call? At times short strangle looks risky when the volatility of the market spikes up.

- 3926 views

- 2 answers

- 0 votes