15

Points

Questions

0

Answers

7

-

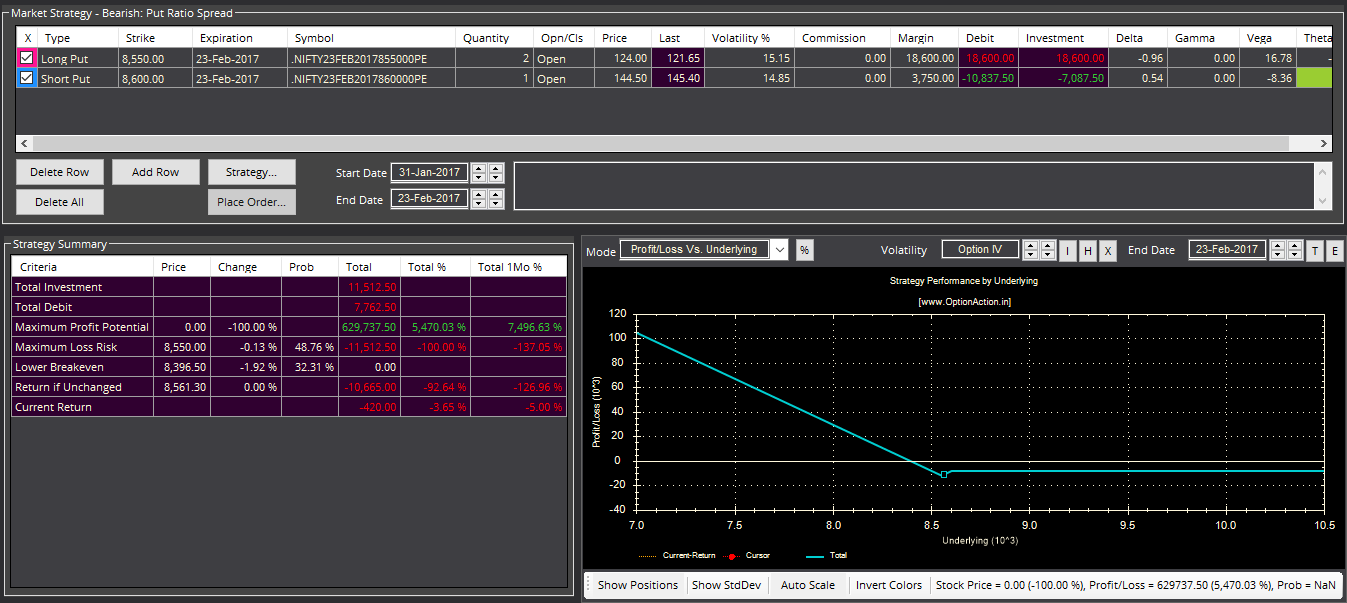

Asked on January 31, 2017 in Options Strategies.

- 3663 views

- 1 answers

- 0 votes

-

Asked on November 24, 2016 in OptionAction.

My Best Wishes to OASupport team for transforming OptionAction into wonderful solution for option traders. Hope in the future optionaction will evolve better than Dough.

- 7723 views

- 4 answers

- 0 votes

-

Asked on November 24, 2016 in OptionAction.

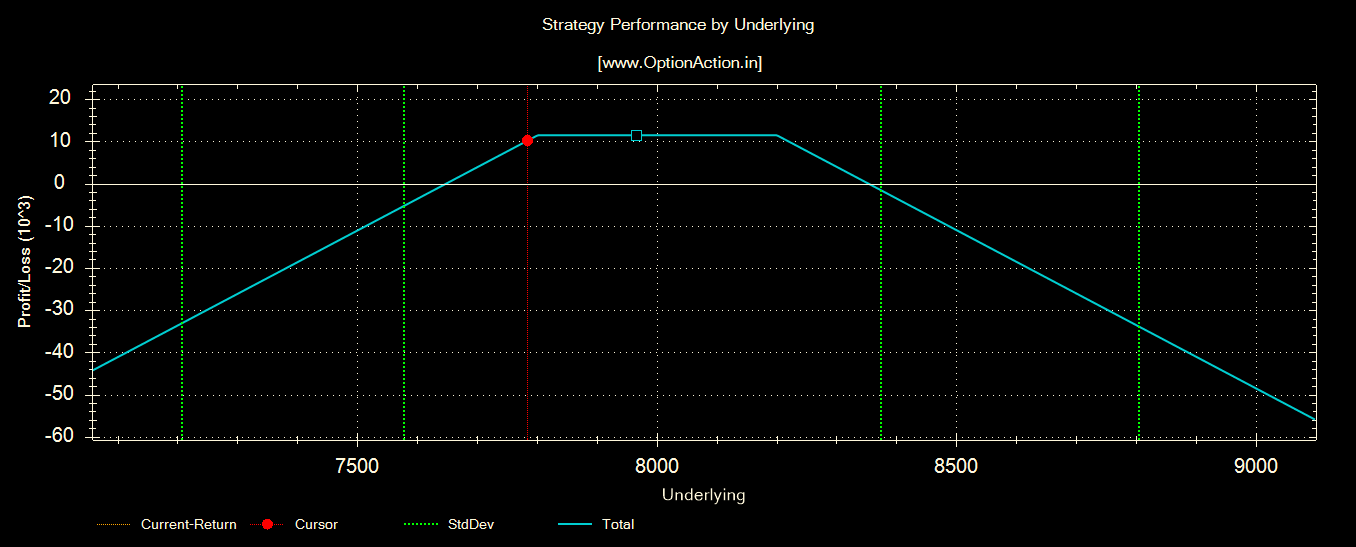

Tested with 1.0.0.4. /iam able to get Std Deviation in Payoff Graph

- 2827 views

- 1 answers

- 0 votes

-

Asked on November 4, 2016 in Options Strategies.

How about trying the Combo of Weekly Option + Monthly Options. Few Neutral Strategies can be built in such a way to benefit from market volatility

- 3474 views

- 2 answers

- 0 votes

-

Asked on October 23, 2016 in OptionAction.

It is very important for an Option trader to understand the STT (Security Transaction Tax) applicable in case he squares-off the position on the expiry day or if the position is exercised by the exchange in case of ITM(In-the-money) option.

Let us take the following two scenarios for better understanding of the STT charges.

Scenario 1: Buy 1 lot of Nifty call option with a strike price of 9000 at Rs.90 and sell it at Rs 100. The STT charged will be Rs 0.425.

(75*100*0.017% = 1.275) i.e. (Quantity * Premium * 0.017%)

Note: STT of 0.017% is charged only the sell side.

Scenario 2: Buy 1 lot of Nifty call option with a strike price of 9000 at Rs. 100 but don’t sell it and let it expire on the last day of the contract.

Now on the day of the expiry if the Nifty Spot closes at 9100, then the call option will be ITM as the Spot price > Strike price & the STT charged will be Rs. 853.125.

(9100*75*0.125%) = 853.125 i.e. (spot price *Qty*0.125%).

Note: STT OF 0.125% is charged, where option is exercised by the exchange otherwise sell side STT is .017%

That is why it is very important to square off all the ITM options on the expiry day,or else the traders has to pay huge sum of money as STT.

- 3591 views

- 1 answers

- 0 votes

-

Asked on October 22, 2016 in Options Greeks.

Second-order Greeks are nothing else but the second-order partial derivatives

of option prices with respect to different variablesVanna: Vanna measures the movements of the delta with respect to small changes in implied volatility (1% change in implied volatility to be precise).

Alternatively, it can also be interpreted as the fluctuations of vega with respect to small changes in the underlying price.Charm (or Delta Bleed): Charm measures delta’s sensitivity to a small movement in time to maturity (T).

In practical terms, it shows how the delta is going to change with the passage of time.Vomma: Vomma measures how Vega is going to change with respect to implied volatility and it is normally expressed

in order to quantify the influence on vega should the volatility oscillate by 1 point.DvegaDtime: DvegaDtime is the negative value of the partial derivative of vega in terms of time to maturity and it measures how fast vega is going to change with respect

to the time decay.Reference : Options Greeks: Vanna, Charm, Vomma, DvegaDtime

- 4217 views

- 1 answers

- 0 votes

-

Asked on October 21, 2016 in Options Strategies.

If you are in Indian markets, something like 3% to 5% monthly is possible with strategies like iron condor & short strangle. Again returns majorly depends upon market understanding and that come with experience.

Knowing a strategy alone is not sufficient. You must know how to execute a strategy.

Many great strategies are there, but we need to understand the implications of market movements for each of these strategies and what adjustments we should do to take care of market swings in order to protect capital as well as generate monthly income. These can be learned with experience , which can be yours or somebody else’s.

- 3925 views

- 2 answers

- 0 votes