9

Points

Questions

2

Answers

2

-

Asked on October 25, 2016 in Options Strategies.

A Strangle generally uses Out of the Money Call/Puts. It is practiced generally during the start of expiry or significant time to expiry.

Short strangles are good to execute if the markets are likely to be range bound to a larger extent. Short Straddles are practiced during near to expiry or when the markets are expected to trade in very small range. More the market stays within the range more premium ends up at zero and the option writer benefits from that

Long Strangles are good execute if there is any big and sharp trends are expected. events like elections/ earning results are in near future where volatility or trend breakout is expected. One can play events using long straddles as well especially when expiry is nearing.

- 3337 views

- 1 answers

- 0 votes

-

Asked on October 25, 2016 in OptionAction.

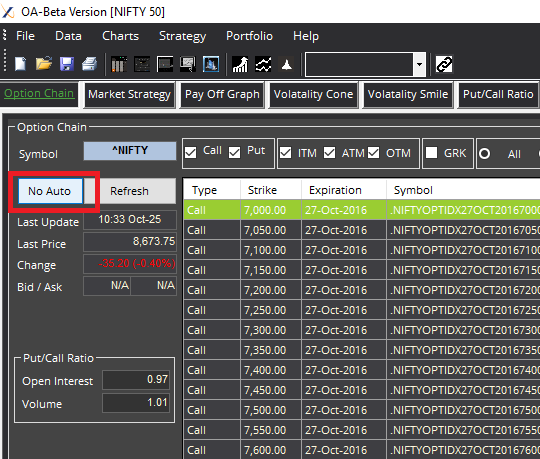

Check on the No Auto Button later you could see the time running and refresh happens every 30 seconds as shown below

- 2708 views

- 2 answers

- 0 votes